- An unparalleled opportunity arises with $82 million worth of advanced EV battery manufacturing equipment available in Belgium and South Korea.

- The collection includes state-of-the-art machinery like cathode and anode notching machines, ready to energize next-gen electric vehicles.

- Manufactured by esteemed South Korean companies such as SLA and WuXi, these machines promise exceptional quality and innovation.

- The equipment’s availability stems from a strategic shift, presenting a rare purchasing opportunity for EV manufacturers.

- Potential buyers are capitalizing on the chance to acquire this technology at competitive prices, seeing it as a launchpad for a sustainable future.

- The sale represents hope and growth in the green sector amid financial uncertainties, appealing to companies globally.

- This scenario is a call to action for enterprises looking to establish or expand their foothold in the clean energy arena.

In the labyrinth of industrial marketplaces, a rare gem emerges—a collection of pristine, advanced EV battery manufacturing equipment, waiting like sleeping giants in Belgium and South Korea. These unused assets, with a collective price tag of approximately $82 million, promise to invigorate enterprises poised to electrify tomorrow.

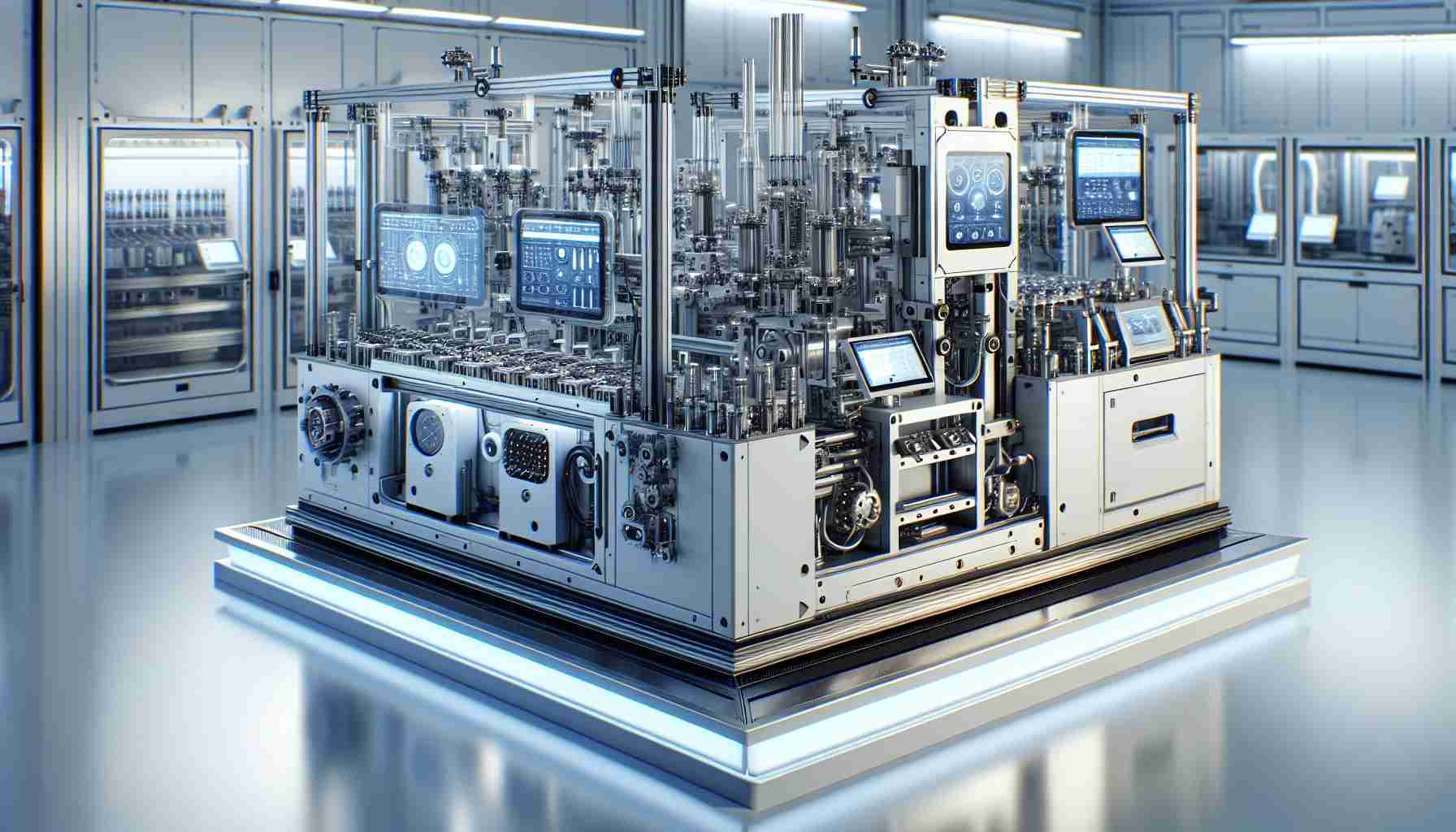

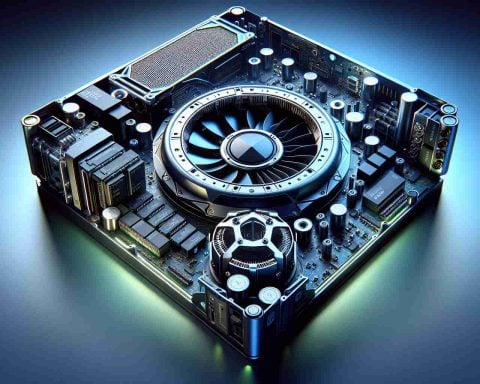

Picture rows upon rows of state-of-the-art machinery, its steel frames gleaming under the warehouse lights. The assembly line includes everything from cathode and anode notching machines to futuristic formation and aging chambers. All the tools necessary to power the next generation of electric vehicles lie patiently in their original crates, eager to roll into action.

The equipment, abandoned mid-stream due to strategic realignment, is a technological feast for EV manufacturers. High-caliber machines crafted by the hands of renowned South Korean manufacturers like SLA and WuXi transform this sale into an opportunity as rare as lightning in a bottle.

Potential buyers have started gathering like moths to a flame, sensing the extraordinary chance to acquire cutting-edge equipment at surprisingly attractive prices. It’s more than just a purchase; it’s a launchpad for a sustainable future, where innovation meets opportunity head-on.

Against the backdrop of financial turbulence in the green sector, this sale stands out not just for its scale but for what it represents. It’s a beacon in a world transitioning steadily toward greener pastures. Companies in Europe, Asia, and beyond now have their sights set on this treasure trove, a dream lineup for anyone ready to steer the wheel of clean energy. Whether establishing new facilities or scaling existing operations, the time to act is now. The future of sustainable technology beckons—will you answer the call?

The Hidden Goldmine in EV Battery Manufacturing Equipment Revealed!

Unveiling the Opportunity in EV Battery Manufacturing

In an industry landscape driven by innovation and transformation, industries focusing on electric vehicles (EVs) find themselves at a pivotal juncture. A remarkable opportunity has emerged for businesses aiming to accelerate their electric vehicle manufacturing capabilities through the acquisition of idle, state-of-the-art EV battery production equipment. With a staggering collective valuation of $82 million, these assets are poised to catalyze a groundbreaking shift towards a sustainable, electric future.

Comprehensive Features and Specifications

The equipment available comprises high-end machinery pivotal to battery cell production, including:

– Cathode and Anode Notching Machines: Precision tools for preparing electrodes, essential for battery efficiency and performance.

– Formation and Aging Chambers: Advanced systems to ensure optimal battery cycle life and reliability.

– Renowned Manufacturing Quality: Produced by distinguished South Korean manufacturers such as SLA and WuXi, ensuring top-tier durability and performance standards.

Pros and Cons of Purchasing Unused EV Battery Equipment

Pros:

1. Cost Savings: The ability to purchase low-cost, high-quality equipment provides significant savings compared to investing in new machinery.

2. Immediate Availability: Access to these assets is immediate, accelerating production timelines without the wait times usually associated with ordering and building new machinery.

3. Technological Edge: Acquire cutting-edge technology that offers superior performance and energy efficiency.

Cons:

1. Adaptation Costs: Depending on existing infrastructure, additional expenses might be incurred to integrate these machines into current operations.

2. Limited Support: If sourced directly from inactive projects, support from original manufacturers might vary, impacting maintenance and upgrade options.

3. Depreciation and Obsolescence: Technology in such a rapidly evolving field can become outdated swiftly.

Market Analysis and Forecast

The electric vehicle market is projected to experience exponential growth over the next decade. As nations globally set ambitious carbon neutrality goals, demand for EVs—and consequently, EV batteries—is anticipated to skyrocket. According to multiple market research forecasts, the global EV market could surpass $800 billion by 2030, bolstering the need for efficient and sizable battery manufacturing capacities.

Security and Sustainability Considerations

Security aspects are paramount when acquiring high-caliber machinery, including ensuring data integrity and protection against industrial espionage. Furthermore, sustainable practices in utilizing these resources, extending from energy-efficient implementation to minimizing waste production, must align with overarching environmental directives.

Innovations and Emerging Trends

The equipment’s availability presents a window into innovative manufacturing processes. With facilities capable of next-generation battery production, such as solid-state batteries, industries can position themselves at the forefront of technological advancements, propelling product performance and sustainability.

Conclusion: Seize the Future

In an era defined by a green metamorphosis, the availability of such industrial resources heralds a unique opportunity. Companies that seize these assets not only harness immediate production advantages but also stake their claim in the burgeoning EV revolution, paving avenues towards a cleaner, more sustainable future.

For further exploration and discussions on industry advancements, visit Manufacturing Global, where insights into technology, market shifts, and manufacturing trends can keep you informed and competitive.